Late on Monday night, the New York Times had released a follow-up on their stunning report of President Donald Trump and his tax returns – with a focus on how he was saved by his hit show on NBC, “The Apprentice” and how that led to a financial windfall that helped propel him to where he is now.

According to the report, heading into the 21st century Trump was well on his way to financial ruin – he had just went through a second divorce, his three casinos in Atlantic City went belly-up and was on his way to bankruptcy court again as he had lost about $353 million by the end of 2002. Despite his portrayal in the public eye as a successful businessman, behind the scenes he was fledgling and looking for a bailout.

Enter British television producer Mark Burnett, who had turned “Survivor” into a ratings hit on CBS. He had approached Trump in 2003 with a similar idea except this time in a boardroom, where Trump would weed out potential entrepreneurs until one was left standing – with the reward of working on a Trump project. Trump agreed with the idea, even going as far as telling NBC that this show would do wonders for his personal branding.

“Even if it doesn’t get ratings, it’s still going to be great for my brand,” Trump had told an NBC executive in 2002 when the idea was conceived.

The show ended up becoming a major success, with Trump making nearly $197 million directly from the show over the 15 seasons it was on the air, and through the fame the show gave him, he made over an additional $230 million in separate endeavors. However, the report showed that Trump also engaged in some risky business endeavors, some which caused a lot of trouble financially not just for him but people who trusted in him: ACN, the Trump Network and Trump University fleecing people out of money after being promised prosperity.

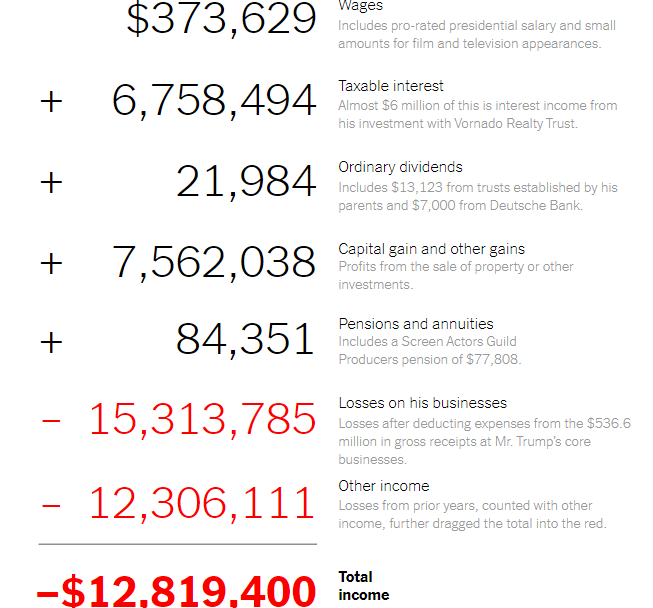

It doesn’t end there. In a second story released on Tuesday, the Times broke down how President Trump, despite claiming he is worth billions, only paid $750 in federal income taxes in 2017. Below is the breakdown of how that was possible:

While Trump donated his presidential salary to charity, it was still subject to income tax but since he had such a high negative income, he didn’t owe regular income tax. That being said, Trump was still subject to the Alternative Minimum Tax, a parallel tax system that reduces the benefit of some deductions, preventing wealthy people from erasing their tax liability altogether. This is where it gets murky.

“Mr. Trump had $22.7 million in General Business Credit, much of it carried forward from prior years, that he could apply,” the report said. “The credit is a smorgasbord of tax incentives and givebacks to business owners, and in Mr. Trump’s case they ranged from credits of $322,926 for Social Security and Medicare taxes paid on employee tips to at least $1.5 million related to rehabilitating the Old Post Office in Washington.”

The business credit only applies against taxes owed; and Trump had more than enough to cancel out his original tax bill of $7,435,857 (what he originally owed via the Alternative Minimum Tax). However on the Form 3800 for the General Business Credit, his accountants subtracted $750 from his allowable credit, which led to what he was left to pay for.